Jul 5th, 2011 | Passive investing | 0 komentárov

US president Obama disclosed his famliy’s financial report for 2010. It shows that their wealth ranges from 2.8 to 11.8 million US dollars. Although the majority of their money is invested in US government bonds when it comes to equities they stick to passive investment strategy – between 200 000 and 450 000 USD rests in the Vanguard 500 Index Fund – the oldest investment fund available. For more detailed information read here.

US president Obama disclosed his famliy’s financial report for 2010. It shows that their wealth ranges from 2.8 to 11.8 million US dollars. Although the majority of their money is invested in US government bonds when it comes to equities they stick to passive investment strategy – between 200 000 and 450 000 USD rests in the Vanguard 500 Index Fund – the oldest investment fund available. For more detailed information read here.

→ pokračovanie článku

May 17th, 2011 | Passive investing | 0 komentárov

Raj Rajaratnam is the founder of the hedge fund company Galleon Group that managed approximately 8 billion USD in 2008 when the fund was at the height of its fame. In 2009, he was arrested by the FBI and few days ago found guilty.

Raj Rajaratnam is the founder of the hedge fund company Galleon Group that managed approximately 8 billion USD in 2008 when the fund was at the height of its fame. In 2009, he was arrested by the FBI and few days ago found guilty.

→ pokračovanie článku

Apr 28th, 2011 | Passive investing | 0 komentárov

Markets are efficient says in an interesting interview Eugene Fama, professor of finance at the University of Chicago. Fama argues that despite some challenges (e.g. momentum investing) passive investing and the notion of efficient markets are valid for each investor. The only persons who are most probably able to beat the market consistently are insiders (e.g. managers of individual companies). However, their trading is legislatively restricted.

Markets are efficient says in an interesting interview Eugene Fama, professor of finance at the University of Chicago. Fama argues that despite some challenges (e.g. momentum investing) passive investing and the notion of efficient markets are valid for each investor. The only persons who are most probably able to beat the market consistently are insiders (e.g. managers of individual companies). However, their trading is legislatively restricted.

Photo: globalreporting.org

Mar 28th, 2011 | Passive investing | 0 komentárov

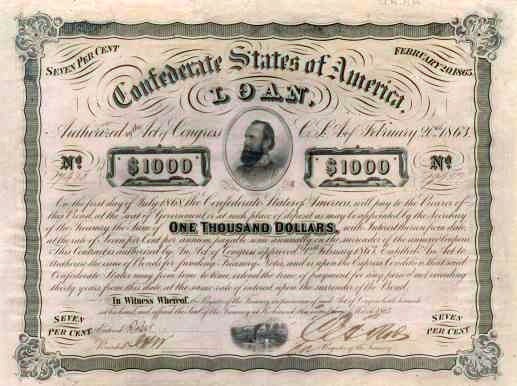

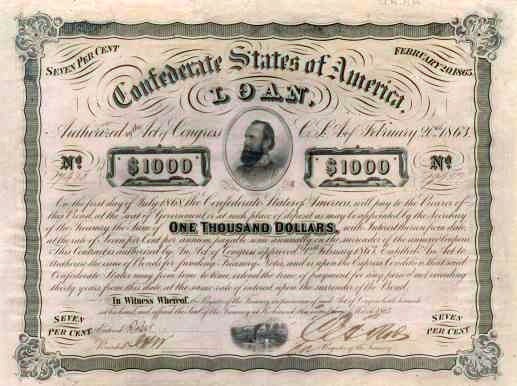

It is important that bonds form an integral part of your portfolio. There are at least two reasons for this. First, bonds are substantially less volatile (risky) than equities and second, they tend to fluctuate independently of the equity prices. In other words, the correlation between bonds and stocks is very weak. This means that in times of stock market woes bonds can save your quiet sleep.

It is important that bonds form an integral part of your portfolio. There are at least two reasons for this. First, bonds are substantially less volatile (risky) than equities and second, they tend to fluctuate independently of the equity prices. In other words, the correlation between bonds and stocks is very weak. This means that in times of stock market woes bonds can save your quiet sleep.

→ pokračovanie článku

Mar 17th, 2011 | Passive investing | 0 komentárov

Larry Swedroe is a research director at Buckingham Asset Management, St. Louis, a company that manages its clients’ assets passively. Once upon a time, he started his career as an active investor at Citicorp. As the time went, influenced by many academic papers supporting passive investing, he became an index investing convert. Have a read through his interview on Indexuniverse.com.

Larry Swedroe is a research director at Buckingham Asset Management, St. Louis, a company that manages its clients’ assets passively. Once upon a time, he started his career as an active investor at Citicorp. As the time went, influenced by many academic papers supporting passive investing, he became an index investing convert. Have a read through his interview on Indexuniverse.com.

→ pokračovanie článku

Mar 6th, 2011 | Passive investing | 0 komentárov

How accurate are political analysts? That is what I asked after having posted a number of articles on financial predicting. Philip Tetlock, professor at University of Berkley, is the man who answered this question in his book Expert Political Judgment: How Good Is It? How Can We Know? It is a summary of his research that lasted for 20 years. It was focused on the accuracy of political forecasts (e.g. will there be a violent end to Soviet Union or not?). He analyzed 284 political commentators and gathered 82 361 predictions.

How accurate are political analysts? That is what I asked after having posted a number of articles on financial predicting. Philip Tetlock, professor at University of Berkley, is the man who answered this question in his book Expert Political Judgment: How Good Is It? How Can We Know? It is a summary of his research that lasted for 20 years. It was focused on the accuracy of political forecasts (e.g. will there be a violent end to Soviet Union or not?). He analyzed 284 political commentators and gathered 82 361 predictions.

→ pokračovanie článku

Feb 24th, 2011 | Finance | 0 komentárov

Indexingblog.com published an article about shady deals of large US banks. For example, Merrill Lynch misused information related to large client orders. The bank used this information to place its trades afterwards. Another blue chip bank – Bank of New York – overcharged Virginia pension plans by almost 20 mio USD in currency trades. The bank used for currency conversions the worst price of the day and pocketed the difference.

Indexingblog.com published an article about shady deals of large US banks. For example, Merrill Lynch misused information related to large client orders. The bank used this information to place its trades afterwards. Another blue chip bank – Bank of New York – overcharged Virginia pension plans by almost 20 mio USD in currency trades. The bank used for currency conversions the worst price of the day and pocketed the difference.

→ pokračovanie článku

US president Obama disclosed his famliy’s financial report for 2010. It shows that their wealth ranges from 2.8 to 11.8 million US dollars. Although the majority of their money is invested in US government bonds when it comes to equities they stick to passive investment strategy – between 200 000 and 450 000 USD rests in the Vanguard 500 Index Fund – the oldest investment fund available. For more detailed information read here.

US president Obama disclosed his famliy’s financial report for 2010. It shows that their wealth ranges from 2.8 to 11.8 million US dollars. Although the majority of their money is invested in US government bonds when it comes to equities they stick to passive investment strategy – between 200 000 and 450 000 USD rests in the Vanguard 500 Index Fund – the oldest investment fund available. For more detailed information read here. Raj Rajaratnam is the founder of the hedge fund company Galleon Group that managed approximately 8 billion USD in 2008 when the fund was at the height of its fame. In 2009, he was arrested by the FBI and few days ago found guilty.

Raj Rajaratnam is the founder of the hedge fund company Galleon Group that managed approximately 8 billion USD in 2008 when the fund was at the height of its fame. In 2009, he was arrested by the FBI and few days ago found guilty. Markets are efficient says in an

Markets are efficient says in an

Larry Swedroe is a research director at Buckingham Asset Management, St. Louis, a company that manages its clients’ assets passively. Once upon a time, he started his career as an active investor at Citicorp. As the time went, influenced by many academic papers supporting passive investing, he became an index investing convert. Have a read through his

Larry Swedroe is a research director at Buckingham Asset Management, St. Louis, a company that manages its clients’ assets passively. Once upon a time, he started his career as an active investor at Citicorp. As the time went, influenced by many academic papers supporting passive investing, he became an index investing convert. Have a read through his  How accurate are political analysts? That is what I asked after having posted a number of articles on financial predicting. Philip Tetlock, professor at University of Berkley, is the man who answered this question in his book

How accurate are political analysts? That is what I asked after having posted a number of articles on financial predicting. Philip Tetlock, professor at University of Berkley, is the man who answered this question in his book  Indexingblog.com

Indexingblog.com  SK

SK EN

EN